The Australian Federation of Ukrainian Organisations (AFUO) has welcomed the signing of a new convention between Ukraine and Australia that is designed to prevent double taxation and stop tax evasion.

The agreement was signed by Ukrainian Finance Minister Serhii Marchenko and Australian Treasury Secretary Jim Chalmers during the annual meetings of the Washington-based lenders International Monetary Fund (IMF) and World Bank.

The deal sets clear rules to ensure that individuals and companies are not taxed twice, once in Ukraine and again in Australia, while making tax procedures simpler, fairer, and more predictable.

This treaty builds on growing ties between the two countries. Australia has been a strong supporter of Ukraine since the start of Russia’s full-blown invasion, providing military aid, humanitarian assistance, and diplomatic backing. Ukrainian and Australian officials have also been working to deepen cooperation in trade, energy, education, and defense, reflecting a steady growth of bilateral relations.

The AFUO has supported this initiative from the start, including last April when it urged the Australian Treasury to prioritize this agreement.

“This treaty is not only a practical step forward — it’s a powerful symbol of Australia’s commitment to Ukraine’s future,” the organization said.

Once in effect, the convention is expected to encourage Australian investment in Ukraine, reduce financial barriers, and create better conditions for trade and cooperation.

For businesses and citizens, this means lower tax risks, greater transparency, and new opportunities for growth.

The AFUO said that this step strengthens the economic partnership between Ukraine and Australia and opens new avenues for further cooperation.

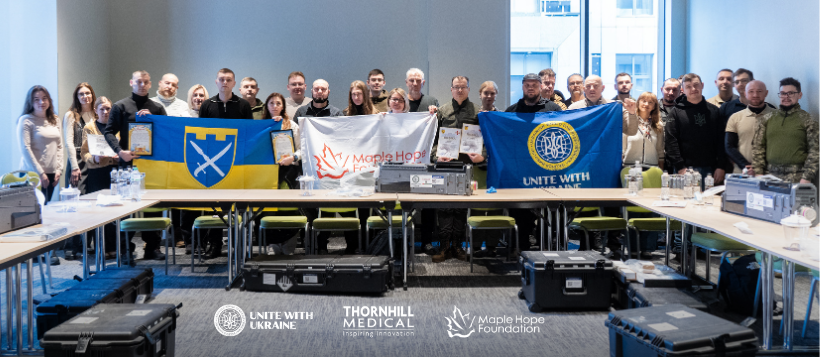

Cover: Ukraine’s Finance Ministry